FedNow Surveillance

The U.S. Federal Reserve is set to launch its digital payments system, FedNow, in July. Described by Richmond Fed President Tom Barkin as “resilient, adaptive, and accessible,” the system aims to facilitate faster, lower-cost bill payments, money transfers, and other consumer activities.

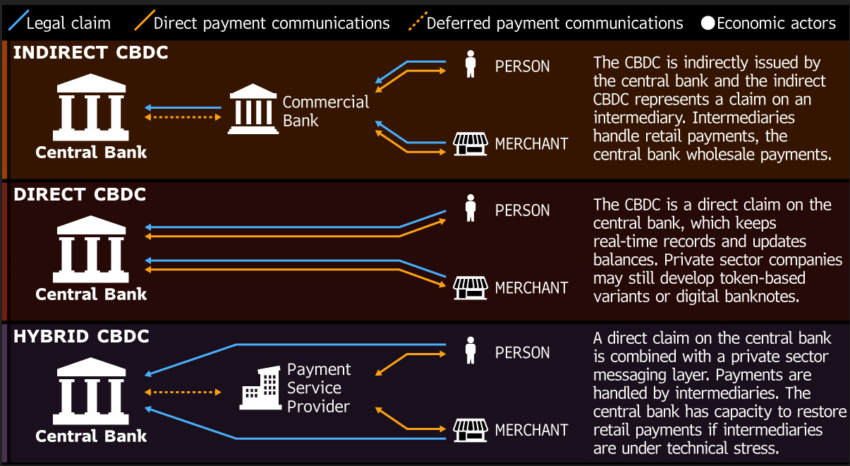

However, as central banks globally pursue Central Bank Digital Currencies (CBDCs), concerns arise about the potential consequences for financial freedom and privacy.

The U.S. to Surveil All Private Financial Affairs

FedNow’s introduction of a CBDC could potentially pave the way for increased government surveillance of private financial affairs.

According to Robert Francis Kennedy Jr., with transactional anonymity gone, central banks would have the power to enforce dollar limits on transactions and restrict where and when money can be spent. A CBDC linked to digital ID and social credit scores could be even more dangerous.

Kennedy maintains that such a system could enable governments to freeze assets. They could even limit spending to approved vendors for those who don’t comply with specific mandates, such as vaccine requirements.

Although initially limited to interbank transactions, the launch of CBDCs raises concerns. These are related to the potential for governments to ban or seize decentralized currencies like Bitcoin, as was the case with gold in 1933.

Governments appear to seek to capitalize on crises like banking instability. For this reason, they are promoting CBDCs as safe alternatives to paper currencies and a means of protection against bank runs.

In light of these concerns, Bitcoin’s decentralized nature and censorship resistance becomes increasingly important.

As a decentralized currency, Bitcoin offers an alternative to CBDCs that can empower individuals and protect their financial privacy.

- Financial sovereignty: Bitcoin allows users to maintain control over their funds without relying on third parties. This independence can empower individuals to manage their finances without interference or censorship from governments or financial institutions.

- Privacy: While CBDCs can enable governments to track and scrutinize individual transactions, Bitcoin transactions are pseudonymous. Although not entirely anonymous, Bitcoin provides a higher degree of privacy than traditional banking systems. It allows users to safeguard their financial data from unwarranted surveillance.

- Borderless transactions: Bitcoin enables seamless cross-border transactions without the need for intermediaries or the constraints of foreign exchange rates. This feature can facilitate international trade, remittance transfers, and global investment opportunities, fostering greater financial inclusion and economic growth.

- Resistance to inflation: Bitcoin’s fixed supply of 21 million BTC and predictable issuance rate can protect users from inflationary pressures. In contrast, CBDCs, as an extension of fiat currencies, would still be subject to the monetary policies of central banks. These include inflationary measures such as quantitative easing.

- Security and resilience: The decentralized nature of Bitcoin’s underlying technology ensures the network’s security and resilience against cyber-attacks and system failures. This contrasts with centralized systems like CBDCs, which can be more vulnerable to hacks or technical issues.

By sidestepping centralized control and surveillance, Bitcoin could play a pivotal role in preserving financial freedom and autonomy in a future dominated by CBDCs.